Who Can Witness A Mortgage Deed?

Who Can Witness A Mortgage Deed? When signing a mortgage deed, having a witness present is essential to guarantee that the document is legally valid and enforceable. The UK mortgage sector has precise criteria and regulations for who can function as a witness throughout this procedure.

A mortgage deed is a legally enforceable document specifying a mortgage offer’s terms and conditions. It is an important part of the mortgage procedure that requires the signature of a witness to be legally binding.

A witness’s function in signing a mortgage deed is to ensure that the person signing the instrument is willing and understands its terms and conditions. The witness must also be present when the signature is made to guarantee that the document is properly signed.

So, who can be a witness when signing a mortgage deed? Specific conditions must be met to ensure the witness is legally binding and appropriate for the function, which we will go over in depth in section 4.

It is critical to understand the legal criteria for the presence of a witness at the signing of a mortgage deed. Failure to do so can result in serious legal problems down the road, as the document may be unenforceable if correct procedures are not followed.

Overall, having a witness present when signing a mortgage deed is critical to ensuring that the document is legally binding and enforceable. Understanding the legal requirements for witnesses is critical for anyone working in the mortgage sector in the UK.

Key Takeaways

- A witness is required when signing a mortgage deed to ensure legally binding and enforceability.

- A mortgage deed is a legally binding document that outlines the terms and conditions of a mortgage offer.

- A witness is responsible for ensuring that the signing is voluntary and that the person understands the document.

- Witnesses must meet specific criteria.

Understanding legal requirements for witnesses is essential for individuals working in the UK mortgage business.

What is a mortgage deed?

A mortgage deed is a legally enforceable document confirming the transfer of property ownership from the seller to the buyer. This agreement also details the terms and conditions agreed upon by both parties, such as the mortgage amount, interest rate, and repayment schedule.

The mortgage deed is an important component of the mortgage offer and has a vital function in the UK mortgage sector. The mortgage deed, once signed, becomes a legally enforceable document outlining the buyer and lender’s agreement.

It’s crucial to understand that the mortgage deed differs from the mortgage offer. The mortgage offer is a document issued by the lender that explains the terms and circumstances of the loan, whereas the mortgage deed is a legal document that verifies the transfer of ownership, making it a legally binding arrangement.

Overall, the mortgage deed is a key document that assures the buyer and lender’s agreement is legally enforceable and protects both parties’ rights.

The Role Of A Witness In Signing A Mortgage Deed

When signing a mortgage deed, having a witness present is essential. The witness plays an important role in ensuring that the document is valid and enforceable. In essence, a witness is an independent third person who certifies that a signature is legitimate and that all parties signed the document in the presence of one another.

The presence of a witness removes any questions regarding the authenticity of the signatures on the mortgage deed. It also guarantees that all parties fully grasp the mortgage’s terms and conditions before signing. The witness attests that the signatories were aware of what they were signing, the ramifications of the agreement, and that they signed the deed voluntarily.

The witness must sign the mortgage deed to indicate that they were there during the signing. The witness’ signature is required to confirm that the mortgage deed is valid and legally binding. Without a witness, the mortgage deed may not be legally binding.

It is vital to note that the witness cannot be a family member or someone who has a financial stake in the property or mortgage. This is done to maintain impartiality and guarantee that the witness is independent and objective in their function. Individuals must sign as witnesses, not as representatives of the lender or borrower.

If a witness is not present to sign the mortgage deed, it will be void. As a result, it is critical to select a witness who is both qualified and reliable. A suitable witness must be above 18, of sound mind, not a party to the mortgage, and able to attend the signing in person.

Overall, a witness’ participation in signing a mortgage deed is crucial to ensuring that the arrangement is genuine and enforceable. They guarantee that all parties comprehend the mortgage’s terms and conditions and sign the instrument in good faith. Without a witness, the mortgage deed may not be legally binding, which can lead to problems such as mortgage fraud.

Examples of suitable witnesses:

| Type of Witness | Suitability |

| Professional, such as a solicitor or notary public | Highly suitable, as they are independent and qualified to handle legal documents |

| Work colleague | Suitable, as long as they do not have a financial interest in the property |

| Friend or neighbour | Suitable, as long as they meet the criteria outlined above |

It is critical to obtain an appropriate witness to guarantee that the mortgage deed is legally binding and enforceable. Failure to have a witness present or an unsuitable witness can jeopardize the mortgage’s legitimacy, thus these rules must be carefully considered.

Legal Requirements for Witnesses

When witnessing a signature on a mortgage deed, a witness must meet numerous legal conditions. These requirements assure the document’s validity and enforceability.

Witnesses must be physically present: According to the Land Registry, the witness must be present when the borrower signs the mortgage deed. This means that witnessing via video call or any other virtual means is unacceptable.

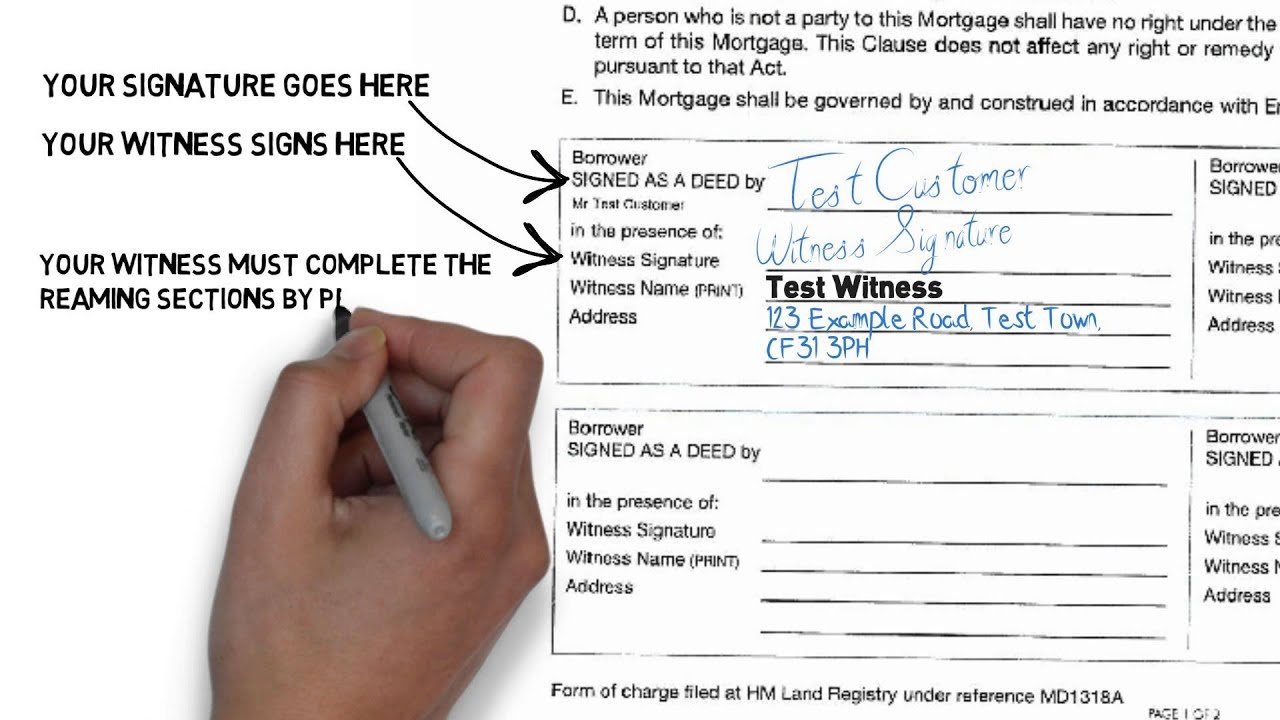

The witness must sign the deed. In addition to witnessing the borrower’s signature, the witness must sign the mortgage deed paperwork. The signature must be in black ink to be distinguished from the borrower’s signature.

Signatures must be separate: The witness’ signature must be different from the borrower’s. This implies that the witness cannot sign on the same line as the borrower. Instead, they must sign a different line or area of the document.

The mortgage deed must be completed. Before signing, the witness must confirm that the entire mortgage deed is correctly completed. This involves ensuring that all required information, such as the borrower’s name and residence, mortgage terms, and any other relevant facts, are filled out correctly.

The attendance of a witness is required while signing a mortgage deed since it provides legal protection for both the lender and the borrower. If the mortgage deed is ever challenged in court, the witness’s testimony can be used to support the document’s legality. To secure the validity of the mortgage deed, the witness must be at least 18 years old and of sound mind. If you are unsure if someone is a proper witness, you should obtain personal legal advice.

Solicitors as witnesses.

In addition to friends and family members, people may choose to have a solicitor witness their signature on a mortgage deed. This is a typical practice since a solicitor has the legal skills and qualifications to verify that the signing process is completed correctly and that the document is legally binding.

According to the Land Registry, a solicitor may act as a witness if they are not a party to the mortgage deed. For example, if a solicitor represents the buyer or seller of the property, they cannot serve as a witness. However, if they have no vested interest in the transaction, they may sign as an independent witness.

Solicitors can serve as witnesses, giving the necessary legal skills to guarantee the mortgage deed is lawful. However, if they have a vested interest in the transaction, they cannot serve as witnesses. Consider contacting a property solicitor for professional guidance on witnessing your mortgage document.

| Pros of Using a Solicitor as a Witness | Cons of Using a Solicitor as a Witness |

| – Legal expertise to ensure the mortgage deed is validly binding and enforceable | – Additional cost for legal services |

| – Can provide guidance on the legal implications of signing the mortgage deed | – May not be available for the signing process |

| – Can sign as an independent witness if not representing any parties in the transaction | – Cannot act as a witness if they have a vested interest in the mortgage transaction |

It is crucial to highlight that, while solicitors can act as witnesses, using their services is not required. If a person feels comfortable utilizing a friend or family member as a witness, there is no need to pay the additional price for hiring a solicitor. However, if one is unclear or intimidated by the legal consequences of a mortgage deed, consulting a solicitor can bring peace of mind and guarantee that the process is performed appropriately.

Independent Witness Requirements:

Having an independent witness is critical to ensuring that the mortgage deed is properly signed. An independent witness, such as a friend or neighbour, cannot have a financial or property stake in the mortgage. Consider consulting with personal legal specialists to verify your witness fits all standards.

It is crucial to remember that not everyone can be an independent witness. To be deemed independent, a witness must meet specified qualifications.

- Witnesses cannot be parties to the mortgage deed, including the borrower, lender, or anybody involved in the transaction.

- Witnesses must be over 18 and have the mental capacity to interpret the mortgage deed.

- Witnesses cannot have any financial or property interests in the mortgage, such as estate agents or solicitors representing the borrower or lender.

To verify that the mortgage document is properly signed, an independent witness should be carefully selected. The witness must understand their role and responsibilities and agree to sign the deed. If an independent witness is not available, a solicitor may act as a witness if they have no interest in the transaction and are not representing any side.

Age Requirements for Witnesses

When signing a mortgage deed, a witness must be present by legal requirements. One such criterion is the witness’ age. Minors are not legally responsible for their conduct and cannot present trustworthy proof if necessary, hence the witness must be at least 18 years old.

Individuals under the age of 18 cannot be present and sign as witnesses, regardless of their maturity or comprehension of the process. The law requires a witness to be mature enough to perform their function in the signing of a legally binding document.

It is critical to underline that the individual must sign as a witness and that their mere presence does not satisfy legal requirements. As a result, it is critical to confirm that the witness is over the age of 18 and understands their duties before signing the mortgage deed.

Finding an Appropriate Witness

When witnessing a signature on a mortgage deed, it is critical to identify a witness who fits the legal standards. If you don’t know someone who would be willing to take on this duty, you have several possibilities.

A solid technique is to hire a solicitor who is conversant with the legal requirements of a mortgage deed. Not only may they serve as witnesses, but they can also provide legal assistance and guarantee that the mortgage deed is properly signed and lodged with the appropriate land registration.

Another alternative is to approach friends or family members who are over 18 and mature enough to observe the signing process. However, it is critical to ensure that they are not parties to the mortgage deed. Otherwise, their witness statement is invalid.

It is vital to emphasize the importance of finding an appropriate witness to guarantee that the mortgage deed is genuine and legally binding. If the document is not properly attested, it may pose serious problems in the future and result in expensive legal processes.

Witnessing the mortgage deed.

When witnessing a mortgage deed, certain standards must be satisfied to ensure that the instrument is legally valid and enforceable. The witness signatures must be separate from the signatories and included in the deed.

The mortgage deed must be signed in front of the witness, who must then sign to confirm that they saw the signatures. This means that the witness must be physically present when the mortgage deed is signed, rather than simply providing their signature afterwards.

To ensure that the mortgage deed is legal, the witnessing process must be completed appropriately. Any inaccuracies or omissions could result in the document being challenged in court, causing considerable delays and costs for all parties concerned.

Table

| Requirement | Description |

| Witness Signatures | Must be separate from those of the signatories |

| Signature Must Be Separate | Must be included in the deed itself |

| Mortgage Deed Must | Be signed in the presence of the witness |

As a result, it is critical to ensure that the entire process is well-documented and that all parties involved completely understand their roles. This entails locating an appropriate witness, confirming they fit the legal criteria for witnessing a mortgage deed and scheduling their presence at the signing.

Following these recommendations will guarantee that your mortgage deed is legally valid and enforceable, so safeguarding your interests and offering peace of mind to all parties involved.

Risks of Mortgage Fraud and Witnessing

Mortgage fraud is a big issue in the UK mortgage market, with numerous incidents recorded each year. Fraudulent acts may include fabricating information on a mortgage application, identity theft, and property fraud. These methods can lead to severe financial losses for both lenders and borrowers.

One of the most effective strategies to prevent mortgage fraud is to have a witness present while signing a mortgage deed. The witness is critical in determining the identification of the individuals engaged in the transaction and ensuring that all parties signed the document voluntarily and with a clear comprehension of its contents.

Without a witness, the mortgage deed may be signed fraudulently, rendering the transaction invalid. This might lead to protracted and expensive legal battles, and the property may even be repossessed.

Furthermore, witness signatures may be cross-checked with other evidence if suspicions of fraud arise, making them an important tool in discovering and prosecuting such cases.

It is important to note that the witness is under no legal responsibility to verify the facts provided in the mortgage deed. Instead, they are there to ensure that the signatories comprehended the document’s conditions and signed freely.

Overall, the witness’ involvement in signing a mortgage deed cannot be emphasized in terms of preventing mortgage fraud. When planning to buy or sell a property, it’s critical to get the mortgage deed witnessed by an appropriate individual, since this easy step assures that the transaction is legally binding and enforceable.

How do I correctly sign my mortgage deed?

A mortgage deed is a formal, legally binding document that certifies you are entering into a contract with your mortgage provider, which is backed by your property.

To be considered a deed, the document must:

- Be in writing.

- Make it obvious that it is intended as an action.

- Be legally executed as a deed.

To be legally executed as a deed, each individual must sign the paper in the presence of a witness. The witness must be an independent individual, such as a friend, neighbour, or coworker. They cannot be a relative or another party to the deed. The witness must sign the deed and include their complete name and address.

The witness should not be younger than 18, in case it is later required to verify the circumstances surrounding the execution and avoid any subsequent challenge to the witness’ trustworthiness or mental capacity based on their age.

The same witness may witness multiple signatures, but each signature must be witnessed independently.

Finally, the mortgage deed must remain undated. Your conveyancer will add the date after the transaction is completed.

FAQ – Who Can Witness A Mortgage Deed?

Who Can Witness A Mortgage Deed?

The witness must be over the age of 18 and have proper maturity. They should not have a personal interest in the mortgage deed or be family members. Furthermore, a witness should be impartial and free of the control or influence of any party involved in the transaction.

What is a mortgage deed?

A mortgage deed is a legally enforceable document indicating a property owner’s willingness to offer a mortgage to a lender. It specifies the terms and circumstances of the mortgage offer, such as the repayment schedule, interest rates, and any further agreements reached between the parties.

The role of a witness in signing a mortgage deed.

A witness in signing a mortgage deed must provide independent verification of the signing procedure. They are in charge of observing the document’s signing, guaranteeing that the signatures are valid, and confirming that it is carried out correctly and in the presence of all parties.

Who Can Witness A Mortgage Deed?

Anyone above the age of 18 who demonstrates proper maturity can serve as a witness. However, the witness must not have a personal stake in the mortgage deed or be a family member. The witness must be independent and without any potential conflicts of interest.

Conclusion

A properly binding and enforceable mortgage deed is essential for both lenders and borrowers in the UK mortgage business. As discussed in this article, the attendance of a witness when signing a mortgage deed is a legal requirement and plays an important role in guaranteeing the document’s legitimacy.

It is important to note that the witness must meet specified criteria and legal standards to be regarded as suitable. As a result, it is critical to take the appropriate procedures to obtain a qualified witness and guarantee that all signature criteria are completed.

Overall, witnessing a mortgage deed is critical to preventing mortgage fraud, protecting both parties’ interests, and ensuring a legally binding and enforceable instrument. When considering signing a mortgage deed, you must seek expert assistance to verify that all legal criteria are completed and that the document is genuine.