Are QR Code Payments Safe? How to Spot a Malicious QR Code (2025 Guide)

From restaurant menus and parking meters to concert tickets and payment terminals, QR codes are everywhere. They promise instant access with a simple scan, but with this convenience comes a critical question: Are they safe?

Unlike a button you can read, a QR code is a black box. You can’t see where it’s taking you until you’ve already scanned it. As a computer scientist, I’m going to demystify this technology. We’ll break down exactly how QR code scams work, give you a simple checklist to spot a fake one, and provide an emergency action plan for what to do if you scan a malicious code. This guide will empower you with the knowledge to use this convenient technology safely and with confidence.

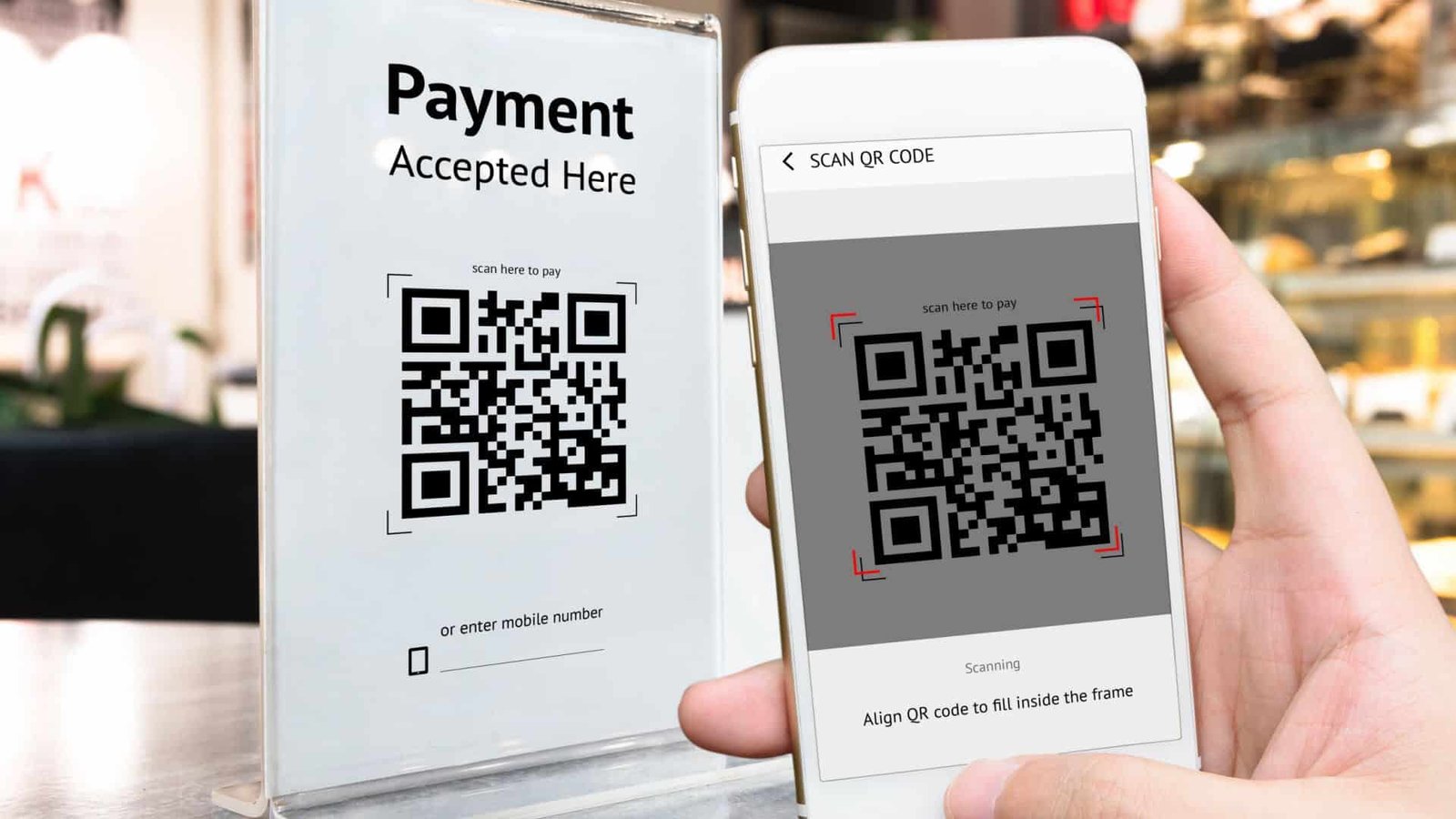

How Do QR Code Payments Actually Work?

The basic mechanism is surprisingly simple. A QR code is a visual representation of text that your phone’s camera reads and translates. Most of the time, that text is a URL (a web address). Once your phone’s camera app or a dedicated QR code scanner translates the code, it automatically opens that URL in your browser. The destination URL then presents a payment page, a menu, or some other web content.

Static vs. Dynamic QR Codes

To be a true expert on the topic, it’s important to understand the two main types of QR codes you’ll encounter.

- Static QR Codes: These are fixed and unchanging. The encoded information, such as a URL or a PayPal.me link, remains the same indefinitely. A small business might print a static code for their main payment link and display it at their counter. While convenient, static codes can’t track individual transactions and are a prime target for scammers who can simply place a sticker of a malicious code over the legitimate one.

- Dynamic QR Codes: These are more sophisticated. They are often generated on the fly for a single, specific purpose. When you see a QR code generated by a digital wallet like Apple Pay or Google Pay on a payment terminal, it’s a dynamic code. These codes often contain transaction-specific information like the exact payment amount, which adds an extra layer of security and ensures the merchant is paid the correct amount.

Now that we understand the mechanics of how QR codes work, let’s address the most important security question: Is the code itself a threat?

The Critical Question: Is the QR Code Itself Dangerous?

This is the most common point of confusion. The answer is no. A QR code itself is just harmless data, like text on a page. The danger is never in the code itself, but in the destination it sends you to.

Think of a QR code like a shortened link (such as a bit.ly link) you receive in an email from a stranger. The link itself isn’t a virus; it’s the malicious website it might lead to. When a scammer uses a QR code, they are using it as a convenient, but deceptive, delivery method for a malicious link. The core threat is what happens after you scan, which is what we’ll explore in detail next.

How Can a QR Code Be Malicious? The Top 3 Threats

Understanding the specific threats is the first step to staying safe. Scammers use QR codes as a vector for a variety of attacks.

1. “Quishing” (QR Code Phishing): The Most Common Scam

This is the most widespread and effective threat. A scammer places a sticker of their malicious QR code over a legitimate one on a parking meter, a restaurant table, or a public display. This malicious code directs you to a fake website that looks identical to a real payment page (like PayPal or a local business’s site). The goal is to steal your login credentials, credit card details, or other personal information. The FTC (Federal Trade Commission) has issued specific warnings about this growing threat.

The fake website may even go a step further and prompt you to download a fake app or log in with your credentials, all while looking perfectly legitimate. This is a classic social engineering attack designed to get you to give away your information voluntarily.

2. Malicious Downloads

A QR code can link directly to a file, not just a website. Scanning it could prompt your phone to download malware, spyware, or a virus. While modern smartphones have safeguards, scammers may trick you into bypassing them. For instance, a malicious website might tell you to “accept” a file download or to change your security settings to “install a new app.” Once installed, this malicious software can log your keystrokes, steal your data, or take control of your device.

3. Unwanted Device Actions

QR codes can be programmed to automatically initiate actions on your phone without a browser. For instance, a malicious QR code could automatically:

- Add a scammer’s contact to your phone’s address book, allowing them to send you spam or phishing messages.

- Compose a premium-rate text message that sends a text to a number that charges you money.

- Connect to an unsecured Wi-Fi network that the scammer controls, making you vulnerable to additional attacks where they can monitor your online activity and steal unencrypted data.

- Trigger a phone call to a number you didn’t intend to dial.

These threats may seem daunting, but the good news is that they are all preventable. The key is to be vigilant and follow a simple, actionable plan.

Your Action Plan: How to Check if a QR Code is Safe Before You Pay

This simple, actionable checklist will make you a QR code detective and empower you to use this technology confidently.

- Physically Inspect the QR Code. Before you even scan, look at the physical code itself. Is it a sticker placed over another code? Does it look tampered with or crooked? Are there unusual signs of glue, paper, or poor printing quality? If it seems out of place, be suspicious.

- Use a Scanner with a URL Preview. This is your single most important defense. Modern phone cameras (and dedicated apps like Google Lens) will show you the full URL before you open it. Always check this URL preview. Do not proceed if your phone’s camera does not show you the full URL.

- On iPhone: Your native camera app will show a yellow banner at the top of the screen with the URL.

- On Android: The camera app or Google Lens will often display the URL at the top or a small pop-up at the bottom of the screen.

- Scrutinize the URL. Once you see the URL, check for key signs of a fake.

- Check the Protocol: Does it start with HTTPS? The ‘S’ stands for secure and means the connection is encrypted. If it’s just HTTP, you should not proceed with a payment.

- Look for Typosquatting: Are there misspellings (e.g., PayPa1.com instead of PayPal.com)? Scammers use these subtle typos to fool your eyes.

- Verify the Domain Name: Does the domain name match the legitimate company? A QR code for a parking service should take you to a domain that includes the parking company’s name, not a generic, unknown website.

- Context is King. Does it make sense for this QR code to be here? A QR code for a payment gateway taped to a random lamppost is a huge red flag. Similarly, a QR code taped to a gas pump should be viewed with extreme suspicion.

- Trust Your Gut. If anything feels off—if the website looks slightly different, the payment process seems strange, or the code looks suspicious—don’t scan it. There’s almost always another, safer way to pay.

These vigilance steps are echoed by top government cybersecurity agencies.

Even with the best precautions, accidents can happen. So, what do you do if you realize you’ve scanned a malicious code?

Emergency Plan: What to Do If You Scanned a Malicious QR Code

You’ve done the scan, and something feels wrong. Here’s your emergency action plan.

- Immediately Disconnect. As soon as you suspect a problem, turn off your Wi-Fi and cellular data. This cuts off any ongoing communication, stops any malware from reporting your location, and prevents further malicious downloads.

- Close the Browser/App. Force quit the application that opened from the scan. This kills any malicious scripts or processes that may be running in the background.

- Delete Any Downloaded Files. Go to your phone’s “Downloads” folder and delete any files you don’t recognize. On Android, this is usually found in a “My Files” or “File Manager” app. On iOS, check the “Files” app.

- Run a Security Scan. Use a reputable mobile security app from the Apple App Store or Google Play Store to scan your phone for malware. Do not trust a website to “scan” your phone for you.

- Change Your Passwords. If you entered any login information on a suspicious site, change that password everywhere you use it immediately, starting with your most important accounts. This is especially critical if you use the same password on multiple websites.

- Monitor Your Accounts. Watch your bank and credit card statements closely for any fraudulent activity. Set up transaction alerts with your bank so you are notified immediately of any charges. Report any suspicious transactions right away. If you believe your entire device is compromised, you should also follow our emergency guide for a lost phone.

While individual vigilance is crucial, businesses also play a key role in protecting customers. Here’s what legitimate businesses do to ensure your QR code payments are safe.

How Businesses Can Make QR Payments Safer for Their Customers

Legitimate merchants understand the importance of trustworthiness and implement a number of security measures to protect their customers.

- Proper Placement and Integrity: Businesses should use official signage and materials for their QR codes. They should never have a QR code placed on a temporary sticker that could be easily covered.

- Integration with Secure Payment Gateways: Legitimate businesses will direct you to a secure, branded payment gateway like Stripe, Square, or PayPal. These services use industry-standard encryption and fraud detection to protect your data.

- Dynamic QR Code Generation: Many businesses, especially those using modern point-of-sale systems, use dynamic QR codes. These codes are generated for each individual transaction and include the specific amount and a unique identifier, making them much harder for a scammer to replicate.

- Clear and Consistent Branding: The landing page for a legitimate QR code will have clear and consistent branding that matches the business you are interacting with.

With these layers of security in mind, let’s address a few more common questions that round out our comprehensive guide.

Frequently Asked Questions (FAQ)

Q: Can scanning a QR code infect your phone or give access to it?

A: Not directly from the scan itself. The scan simply translates the code into a format your phone can understand. However, it can trick you into authorizing a malware download or giving away your credentials, which then leads to a compromise.

Q: Is it safe to scan a QR code to receive money?

A: Generally, yes. Apps like Cash App or PayPal use QR codes for this. The risk is low because you are not entering any payment info. However, be wary of “overpayment” scams where someone sends you too much and asks for a refund.

Q: What happens when I scan someone’s WhatsApp QR code?

A: This is for linking your account to WhatsApp Web or Desktop. It is not a payment system. Only scan this on the official WhatsApp website on your computer screen to avoid someone hijacking your session.

Q: How can I check if a QR code is for a legitimate merchant?

A: Preview the URL. A legitimate merchant will use a known payment gateway (like Stripe, Square, or PayPal) or their own official website domain that is a common domain you would see in their physical store. A scammer will use a misspelled version of the domain or a completely unrelated domain.

Q: Are QR codes for Wi-Fi or vCards safe to scan?

A: These QR codes typically contain network credentials or contact information. The risk is lower than with payment codes, but still exists. A malicious Wi-Fi QR code could connect you to an unsecure network, and a malicious vCard could contain a link that tricks you into visiting a phishing site. Always preview the content before accepting it.

Q: How do I keep my phone secure for mobile banking?

A: You should always use a password or biometric security to lock your phone. You should also enable Two-Factor Authentication (2FA) and keep your phone’s operating system updated to the latest version. Finally, only download apps from official app stores.

Q: Is it safe to use a public QR code generator?

A: Public QR code generators are generally safe for creating a simple QR code for personal use. However, for a business that needs to track data or ensure security, a reputable, paid service is a better option. Avoid any free generator that requires you to enter sensitive information.

Conclusion

QR codes are powerful tools, but their safety is not a given. Their security depends entirely on the user’s vigilance and the integrity of the business providing the code. The golden rule remains: Treat every QR code with the same healthy skepticism you would a link in a strange email.

By learning to be a ‘QR code detective’—physically inspecting the code, previewing the URL, and scrutinizing the destination—you can confidently use this convenient technology while keeping your financial information safe. Stay vigilant, stay secure.

Oladepo Babatunde is the founder of TechFinanceGuide.com and a seasoned technology professional specializing in the dynamic intersection of technology and finance. As a Computer Science graduate (HND) with over a decade of hands-on experience in the tech sector since 2011, he combines deep technical knowledge with a passion for financial innovation.

Oladepo’s mission at TechFinanceGuide is to bridge the gap between powerful financial technology and the everyday user. He is committed to delivering well-researched, actionable content that empowers readers to make informed financial decisions, navigate digital payment systems safely, and understand the trends shaping our future. From blockchain and investment tools to cybersecurity and mobile banking, his articles provide clear guidance in an ever-evolving landscape.

Beyond writing, Oladepo remains a dedicated analyst of the tech landscape, constantly evaluating the breakthroughs that reshape global finance. Connect with him on LinkedIn for in-depth discussions and insights on leveraging technology in the world of finance.