How to Activate iMobile: Your Ultimate Guide to ICICI’s Mobile Banking App

Welcome to TechFinanceGuide.com! If you’re looking to simplify your banking experience with ICICI Bank, you’re in the right place. Mobile banking is a game-changer, offering convenience at your fingertips. In this guide, I’ll walk you through how to activate iMobile, ICICI’s robust mobile banking app. Whether you’re a tech enthusiast or just looking to streamline your finances, this guide will cover everything you need to know to get started with iMobile.

What is the iMobile App?

The iMobile app by ICICI Bank is a comprehensive mobile banking solution that brings a wide range of banking services to your smartphone. From checking your balance to transferring funds, the app makes managing your finances quick and easy.

Overview of the iMobile App by ICICI Bank

ICICI’s iMobile app offers a seamless and secure platform for banking on the go. With a user-friendly interface and a host of features, it caters to all your banking needs without requiring you to visit a branch.

Features and Benefits of Using iMobile for Mobile Banking

Now, you might be wondering, “Why should I bother with iMobile when I can just visit a branch or use online banking?” Well, my friend, let me tell you, iMobile offers a whole bunch of benefits that make it a must-have for anyone who values their time and financial freedom:

- 24/7 Access: Perform banking transactions anytime, anywhere.

- Fund Transfers: Easily transfer funds using NEFT, RTGS, or IMPS.

- Bill Payments: Pay your utility bills, recharge your phone, and more.

- Account Management: Check balances, view statements, and manage multiple accounts.

- Secure Transactions: Enhanced security features like PIN, fingerprint, and face recognition.

How to Download the iMobile App?

Getting started with iMobile is simple. Here’s how you can download the app:

Steps to Download iMobile from the Google Play Store and Apple App Store

For Android Users:

- Open the Google Play Store.

- Search for “iMobile by ICICI Bank”.

- Click on “Install”.

For iOS Users:

- Open the Apple App Store.

- Search for “iMobile by ICICI Bank”.

- Click on “Get”.

Alternative Download Method via SMS Link

- Visit the ICICI Bank website.

- Navigate to the mobile banking section.

- Enter your mobile number to receive a download link via SMS.

- Click on the link in the SMS to download the app directly to your device.

How to Activate iMobile?

Now that you have the app, let’s move on to the most important part: activation. Follow these steps to activate iMobile:

Step-by-Step Activation Process

- Ensure Your Registered Mobile Number is in Your Device:

- Make sure the SIM card with the registered mobile number is in the device you are using to activate iMobile.

- Open the App and Select “I Already Have an Account”:

- Launch the iMobile app.

- Tap on “I already have an account”.

- Tap on “Activate Now” to Send an SMS for Verification:

- Click on “Activate Now”.

- An SMS will be sent from your device to verify your mobile number.

- Choose a Login Method:

- You can select from PIN, fingerprint, or net banking credentials.

- For PIN: Set a 4-digit login PIN.

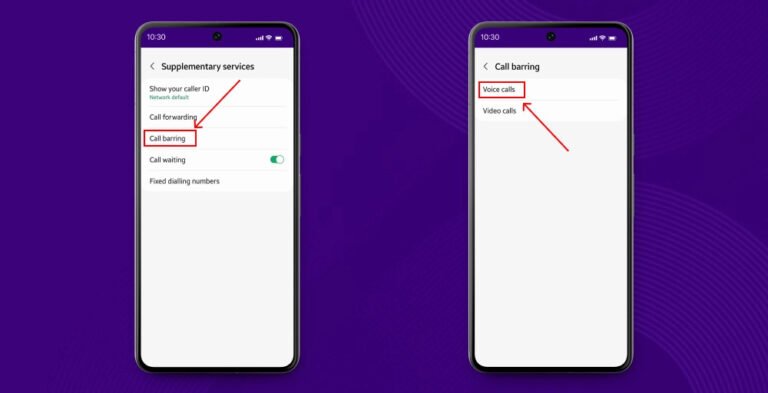

- For fingerprint: Enable fingerprint recognition in your device settings.

- For net banking: Use your net banking User ID and password.

- Complete the Activation:

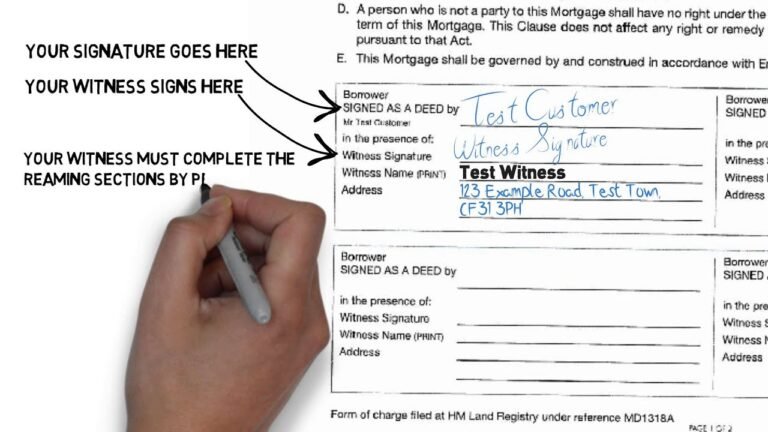

- Use your debit card grid numbers or net banking User ID and password to complete the process.

- Follow the on-screen instructions to finalize the activation.

To activate iMobile, ensure your registered mobile number is in your device, open the app, select “I already have an account”, tap “Activate Now” to send an SMS for verification, choose a login method, and complete the activation using your debit card grid numbers or net banking User ID and password.

How to Log In to iMobile?

Once activated, logging into iMobile is straightforward.

Methods for Logging in After Activation

- Using a 4-digit PIN:

- Enter the 4-digit PIN you set during activation.

- Fingerprint Login Option:

- Place your registered fingerprint on the device’s sensor to log in.

- Net Banking User ID and Password:

- Use your ICICI net banking credentials for access.

How to Use iMobile Pay?

iMobile Pay is a feature within the app that allows you to make payments quickly and securely.

Introduction to iMobile Pay

iMobile Pay transforms your mobile into a virtual wallet. You can make payments to contacts, merchants, and even utility bills with just a few taps.

How to Make Payments Using iMobile Pay

- Open the iMobile App:

- Navigate to the iMobile Pay section.

- Select the Payment Option:

- Choose from options like Send Money, Pay to Contact, or Bill Payment.

- Enter Payment Details:

- Provide the recipient’s details and the amount to be transferred.

- Confirm the Payment:

- Review the details and confirm the transaction using your PIN or fingerprint.

Troubleshooting Common Issues with iMobile Pay

If you encounter issues with iMobile Pay, here are some quick fixes:

- Ensure a Stable Internet Connection: Payments require a good internet connection.

- Check for App Updates: Update the app to the latest version for the best experience.

- Verify Recipient Details: Double-check the recipient’s information before confirming payments.

How to Activate iMobile Without SMS?

If SMS verification is not possible, you can still activate iMobile using your net banking credentials.

Alternative Activation Methods

- Using Net Banking Credentials:

- Open the iMobile app.

- Select “I already have an account”.

- Choose to activate using net banking.

- Enter your ICICI net banking User ID and password.

- Follow the on-screen instructions to complete activation.

iMobile Net Banking Features

iMobile integrates many net banking features for a holistic banking experience.

Overview of Net Banking Services Available Through iMobile

- Fund Transfers: Transfer money to any bank account.

- Bill Payments: Pay bills for utilities, credit cards, and more.

- Investments: Manage your mutual funds, fixed deposits, and other investments.

- Loans: Apply for loans and check loan details.

How to Link Your Net Banking Account with the iMobile App

- Ensure your net banking account is active.

- Use your net banking User ID and password during iMobile activation.

- Follow the prompts to link your accounts seamlessly.

Common Issues and Troubleshooting

What to Do if iMobile Pay is Not Working

- Check Internet Connection: Ensure you have a stable connection.

- Update the App: Make sure you’re using the latest version of iMobile.

- Reinstall the App: Uninstall and reinstall the app if issues persist.

- Contact Customer Support: Reach out to ICICI Bank’s customer service for further assistance.

Steps to Resolve Common Activation and Login Issues

- Verify Mobile Number: Ensure your registered mobile number is in the device.

- Check SMS Permissions: Allow the app to send and receive SMS.

- Update Operating System: Make sure your device’s OS is up to date.

- Restart Your Device: Sometimes, a simple restart can resolve activation issues.

Frequently Asked Questions (FAQs)

Can I Activate iMobile if My Registered SIM Card is in a Different Phone?

No, for security reasons, the registered mobile number must be in the device you are using to activate iMobile.

How to Reset My iMobile PIN?

Open the iMobile app.

Go to “Settings”.

Select “Change PIN”.

Follow the prompts to reset your PIN.

What Should I Do if I Face Errors During Fund Transfers?

Check Recipient Details: Ensure the account details are correct.

Verify Bank Status: Sometimes, fund transfers can fail due to maintenance activities at the recipient’s bank.

Retry Later: Wait a few minutes and try the transaction again.

Contact Support: If the issue persists, contact ICICI Bank’s customer service.

Conclusion

Activating and using the iMobile app by ICICI Bank is a breeze once you know the steps. This guide has walked you through how to activate iMobile, log in, use iMobile Pay, and troubleshoot common issues. With these tips, you can harness the full potential of mobile banking and manage your finances effortlessly. If you found this guide helpful, share it with friends and family, and explore more tech and finance tips on TechFinanceGuide.com! Happy banking!

8 Comments