Apple Pay vs. Google Pay: An In-Depth 2025 Comparison

In 2025, paying with your phone is the new normal. The two giants dominating this space are Apple Pay and Google Pay. But beyond the tap, how different are they really?

Which platform is better, safer, and more convenient for you? The truth is, the best choice for you likely depends on the phone in your pocket. However, there are key differences in their features, ecosystem, and future strategy that are crucial to understand. As a Computer Scientist, we’ll go beyond a simple feature list to analyze their core technology, security models, and strategic differences to help you make an informed decision.

Security: Are Apple Pay and Google Pay Equally Safe?

This is the most common question users ask, and the expert verdict is clear: for in-store transactions, their core security is virtually identical and incredibly robust. Both platforms are built on the same “gold standard” security pillars that make them significantly safer than using a physical credit card.

Shared Security Foundations

To put it simply, both Apple Pay and Google Pay use the same foundational technology to protect your financial information.

- Tokenization: This is the most critical security feature and the primary reason mobile wallets are so safe. When you add your credit or debit card to a mobile wallet, your phone doesn’t store your real card number (known as the Primary Account Number, or PAN). Instead, the app securely sends your card information to your bank and the card network (like Visa or Mastercard). They then replace your real card number with a unique, randomized, and one-time-use code called a token. When you make a payment, your phone sends this token—not your real card number—to the merchant’s payment terminal. If a hacker were to somehow intercept this token, it would be completely useless to them because it’s a single-use key. This process is based on security standards created by EMVCo.

- Secure Hardware: Both platforms store your encrypted payment tokens in a dedicated, tamper-proof hardware chip on your phone. Apple calls this the Secure Enclave and Android uses a similar Trusted Execution Environment (TEE). This hardware is a digital vault that is completely isolated from the phone’s main operating system. It acts as a physical barrier that protects your data from being accessed by malware, viruses, or even a determined hacker.

- Biometric Authentication: To access and use a token from the Secure Hardware, you must first verify your identity with a fingerprint scan or face recognition. This ensures that even if a thief steals your phone, they can’t make a payment without your biometrics. This technology is a core part of the FIDO Alliance’s standards, which are a set of open security specifications for secure authentication.

Fraud Protection & Dispute Resolution

Beyond the underlying technology, both companies have robust systems in place to protect you from fraud. Since the transaction is tokenized, if a fraudulent charge occurs, the bank and card network’s liability is often limited. You can report the fraudulent transaction directly through the app, which then kicks off the bank’s dispute resolution process. In a sense, the tokenization process itself is a powerful anti-fraud measure, as it prevents the exposure of your real card number in the first place.

When it comes to the technical security of in-store payments, both platforms are fundamentally identical and incredibly secure. With that established, let’s turn our attention to the features that truly set them apart.

The Head-to-Head Comparison (2025 Features)

When it comes to features, the two services have a lot in common, but their platform strategy creates a number of key differences.

| Feature | Apple Pay | Google Pay / Wallet | Verdict |

|---|---|---|---|

| Primary Platform | iOS (iPhone, iPad, Apple Watch) | Android | Tie |

| Device Availability | Exclusive to Apple devices | All modern Android devices, some features on iOS | Google Pay |

| In-Store Payments | Seamless, double-click side button | Tap and unlock your phone | Tie |

| P2P Payments | Apple Cash, iMessage integration. Apple-to-Apple only. | Integrated into Google Wallet. Cross-platform. | Google Pay |

| Support Beyond Payments | Store cards, transit passes, car keys, event tickets | Store cards, transit passes, car keys, health passes, event tickets | Google Pay |

| Ecosystem | A “walled garden” approach for a seamless experience. | An open, platform-agnostic approach. | Tie |

Availability & Device Support

Apple Pay is the quintessential “walled garden” product. It is exclusive to Apple devices like the iPhone, Apple Watch, iPad, and Mac. This approach allows for a deeply integrated and highly polished user experience. On the merchant side, Apple has also introduced “Tap to Pay on iPhone,” a feature that allows a merchant to accept contactless payments directly on an iPhone, without the need for any external hardware.

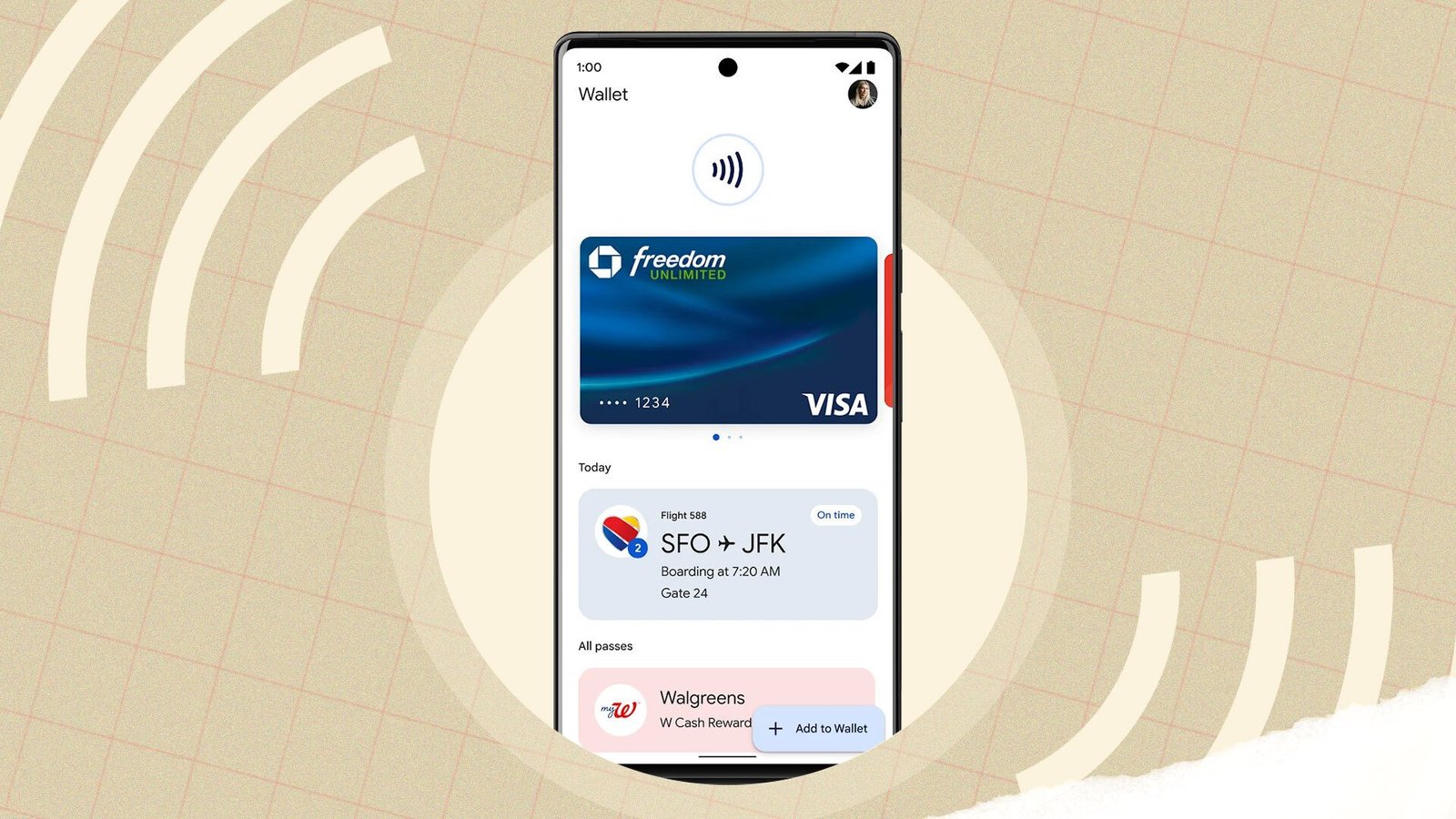

Google Pay and its new evolution, Google Wallet, are designed to be ubiquitous. Google Wallet is the default for all modern Android devices and can even be downloaded on iOS to use its peer-to-peer (P2P) payment features. This open-platform strategy is a key differentiator, as it makes Google Wallet far more flexible for users in a mixed-device world.

In-Store Experience & Ease of Use

Both services are incredibly simple to use for contactless payments, which is why they have become so popular.

- Apple Pay is known for its seamless integration. On an iPhone, a simple double-click of the side button brings up your wallet, ready to authenticate with Face ID. The transaction is completed in a matter of seconds. On an Apple Watch, you can just tap the device to the terminal, and the payment is almost instantaneous. The experience is designed to be effortless and intuitive.

- Google Pay is also very simple. Typically, all an Android user needs to do is unlock their phone and tap the terminal. For even faster payments, you can enable a feature that allows you to pay without unlocking your phone for transactions below a certain threshold. The experience is highly polished and has been refined to be as quick and seamless as possible.

Peer-to-Peer (P2P) Payments

This is where the two services have a major difference, especially for users who frequently send money to friends or family.

- Apple Cash is integrated directly into iMessage. This makes it incredibly easy and intuitive for users who communicate primarily on iPhones, allowing them to send money as if they were sending a text message. However, it is limited to the Apple ecosystem. It is completely useless for a user who needs to send money to a friend with an Android phone.

- Google Pay’s P2P service is cross-platform and works between any users with the app, regardless of whether they are on an Android or iOS device. For families or friends with a mix of phones, this offers a more flexible and convenient solution, as it removes the barrier of a walled garden.

The “Wallet” – Beyond Payments

Both platforms are rapidly expanding beyond simple payments to become a central digital wallet for your entire life. Both now support loyalty cards, transit passes, digital car keys, and event tickets. Google Wallet, however, has been more aggressive and open in its partnerships, including support for digital IDs and health passes. For example, some U.S. states now allow you to add your driver’s license to your Apple Wallet, while Google is working with a broader range of institutions to support similar credentials, positioning itself as a universal digital identity hub.

The feature set for both platforms is constantly evolving, but the core distinction remains: Apple’s focus on a seamless, integrated ecosystem versus Google’s push for an open, universal platform. This core difference drives their strategies for the future.

The Future of Payments: What is Apple’s and Google’s Strategy for 2025?

This section directly addresses the user’s anxiety about the future of these platforms and provides a strategic overview that sets this article apart.

The Future of Apple Pay

Apple’s strategy is to deepen the integration within its closed ecosystem, making Apple Pay the default checkout for all Apple-related services. It aims to lock users into its ecosystem by offering services that only work on Apple devices, such as the now-discontinued “Apple Pay Later” service. In 2024, Apple shifted to a new model of offering installment loans through third-party banks directly within the Apple Pay checkout flow. This shows a focus on providing financial services within the existing wallet framework. In addition, Apple has expanded its “Tap to Pay” feature, allowing merchants to accept payments directly on an iPhone without extra hardware, creating an even more seamless experience.

The Future of Google Pay (and Why It’s Not Dying)

For a long time, users wondered, “Is Google Pay dying?” The answer is a clear no; it’s evolving and expanding its scope. Google strategically rebranded its core payments app to Google Wallet in many regions. The new name better reflects Google’s goal to make it a comprehensive digital wallet for your entire life, not just a payment app. The focus is on a broader range of digital items, from loyalty cards and tickets to digital keys and IDs. This strategy positions Google Wallet as a central hub for all your digital credentials, making it a key part of Google’s long-term vision for a more connected world.

Understanding their strategic directions is key to understanding why each platform makes the decisions it does. Now, let’s take an honest look at the downsides of each service.

Disadvantages and Limitations: An Honest Look

No comparison is complete without a look at the downsides of each platform. This section builds trust by providing a balanced and honest perspective.

Disadvantages of Apple Pay

- The “Walled Garden”: The primary disadvantage is that you are locked into the Apple ecosystem. Apple Cash, for example, is useless for P2P payments if your friend has an Android phone. This can be a major inconvenience for families or groups of friends who use different devices.

- Limited Customization: Apple Pay has a very streamlined and simple interface, but this comes at the cost of customization. Users cannot change the layout or add extra features that are not approved by Apple.

Disadvantages of Google Pay

- User Experience Fragmentation: For years, Google has been criticized for its confusing branding, with the lines between Google Pay and Google Wallet being blurred in some regions. While this has been addressed with the Google Wallet rebrand, some confusion may remain.

- Data Privacy Concerns: While Google states that it anonymizes your transaction data, for users who are extremely wary of Google’s data model, this is a potential con. The fact that Google’s core business is built on advertising and data can be a non-starter for some users.

By understanding the limitations of each platform, you can make a more informed choice that aligns with your priorities. But what about the other side of the transaction?

The Merchant’s Perspective: Why Businesses Choose One Over the Other

A key part of the mobile payments ecosystem is merchant adoption. While both Apple Pay and Google Pay use the same underlying technology, there are a few reasons why a merchant might prefer one over the other, or why they might have to accept both.

Terminal Compatibility & Ease of Integration

Because both services are based on the same NFC (Near-Field Communication) technology and the EMVCo tokenization standard, any modern NFC-enabled payment terminal will automatically accept both Apple Pay and Google Pay without any extra effort from the merchant. This is a huge win for both sides. The only requirement is that the merchant has a modern, contactless-enabled terminal.

Consumer Base & Strategic Partnerships

A merchant’s choice to promote one service over the other often comes down to their target consumer. If a business caters to a user base that is heavily on iPhones, they might be more inclined to highlight Apple Pay. If a business is a key partner in Google’s ecosystem (e.g., a major retailer that integrates with Google Maps and loyalty cards), they may be more inclined to promote Google Pay.

Fees

There is a common misconception that businesses pay extra fees for accepting mobile payments. This is not true. Merchants pay the standard card processing fees (e.g., for Visa or Mastercard), which are the same whether the customer pays with a physical card or a mobile wallet.

Understanding the merchant’s side of the equation provides a complete picture of the mobile payments ecosystem and highlights why both platforms are so successful. Now, let’s bring it all together for a final verdict.

The Final Verdict: Which Mobile Wallet is Best for You?

The best choice is highly dependent on your personal situation.

- For the Dedicated iPhone User: Apple Pay is the undeniable winner due to its seamless hardware and software integration. It’s the most polished, secure, and native experience on the market for Apple users.

- For the Android User: Google Wallet is the powerful, versatile, and default choice. Its open platform strategy and aggressive support for new features make it an excellent tool.

- For Cross-Platform Families/Friends: Google Pay’s P2P service is more flexible and works for everyone, regardless of their device. This is a major benefit for those who frequently send and receive money from a mixed-device group.

- For the Ultimate Privacy Advocate: Apple Pay has a slight edge due to its stated privacy policies and business model that is not reliant on user data for advertising.

Frequently Asked Questions (FAQ)

Q: What is the maximum limit on Apple Pay?

A: There is no limit from Apple Pay itself. The limit is determined by your bank and your individual credit/debit card’s transaction limit.

Q: Does Apple Pay or Google Pay charge a fee?

A: No, neither service charges the consumer a fee for making payments.

Q: Is it safe to enter an ATM PIN in Google Pay?

A: Yes, in the right context. This is typically required for online purchases using a debit card where the bank requires the PIN for verification. The information is transmitted securely, but it’s a different process than an in-person ATM withdrawal.

Q: Which country uses Google Pay the most?

A: India has historically been one of the largest and most active markets for Google Pay’s P2P and QR code features.

Q: Which app is better than Google Pay?

A: The term “better” is subjective. While Apple Pay is the primary competitor, other apps like Samsung Wallet and PayPal also offer similar features. The best one for you depends on your device and specific needs.

Q: Why does Apple Pay fail?

A: Apple Pay transactions can fail for several reasons, including a dead phone battery, an inactive or expired card, or a terminal that isn’t NFC-enabled.

Q: Is Apple Pay safe from hackers?

A: Yes, it is. The biggest threat is an account takeover, which is why enabling two-factor authentication on your Apple ID is so important.

Q: Is Gpay better than Apple Pay?

A: This depends on the user’s needs. GPay offers more cross-platform flexibility for P2P payments, while Apple Pay is designed for a seamless, secure, and integrated experience within the Apple ecosystem.

Oladepo Babatunde is the founder of TechFinanceGuide.com and a seasoned technology professional specializing in the dynamic intersection of technology and finance. As a Computer Science graduate (HND) with over a decade of hands-on experience in the tech sector since 2011, he combines deep technical knowledge with a passion for financial innovation.

Oladepo’s mission at TechFinanceGuide is to bridge the gap between powerful financial technology and the everyday user. He is committed to delivering well-researched, actionable content that empowers readers to make informed financial decisions, navigate digital payment systems safely, and understand the trends shaping our future. From blockchain and investment tools to cybersecurity and mobile banking, his articles provide clear guidance in an ever-evolving landscape.

Beyond writing, Oladepo remains a dedicated analyst of the tech landscape, constantly evaluating the breakthroughs that reshape global finance. Connect with him on LinkedIn for in-depth discussions and insights on leveraging technology in the world of finance.